As we move into the second half of 2025, many homebuyers are wondering… what exactly is going on with the housing market?

Some headlines say the market is heating up. Others claim it’s slowing down. Both seem true—and here’s why.

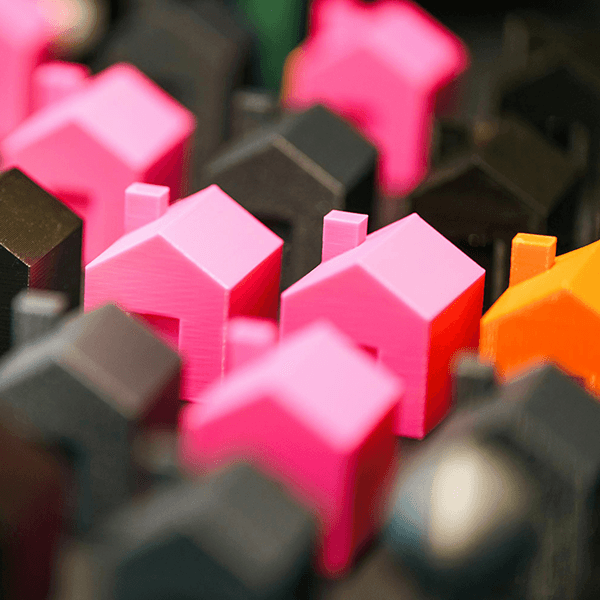

Two Housing Markets Are Happening at Once

Right now, we’re seeing a “Tale of Two Housing Markets”:

-

Demand Is Growing

More people are trying to buy homes. Lower mortgage rates over the past few weeks have brought more buyers back into the market. -

Inventory Is Still Tight

Even though more listings have popped up recently, it’s still not enough. The number of homes for sale is far below what’s needed to meet buyer demand.

What Does This Mean for Homebuyers?

You might be seeing homes go under contract quickly—or sitting longer than expected. You might notice price drops in one area and bidding wars in another. That’s because market conditions vary greatly by city, neighborhood, and even price point.

Some homes (especially updated or move-in ready ones) are flying off the market. Others are lingering, especially if they’re overpriced or in less competitive areas.

The Takeaway

If you’re feeling confused about the housing market, you’re not alone. The key is to focus on your local market—not national headlines.

A knowledgeable loan officer and real estate agent can help you cut through the noise and guide you with accurate, neighborhood-specific data.

Now may be a smart time to buy—especially with mortgage rates still near recent lows—but success depends on having the right strategy.

#HousingMarket2025 #HomeBuyingTips #RealEstateTrends #LowInventory #BuyerDemand #MortgageAdvice #LocalMarketMatters #TaleOfTwoMarkets

Source: Keeping Current Matters