A Quiet Day With a Small Move

Today was another calm but slightly weaker day for the mortgage market. With the government shutdown still holding up key reports like jobless claims, there wasn’t much fresh data to guide investors. That left the bond market trading mostly on technicals — and a bit of selling pressure early in the day nudged yields higher.

The Federal Reserve’s Jerome Powell did appear in a pre-recorded speech this morning, but he made no new comments about monetary policy. Without that catalyst, markets turned their attention to the day’s only potentially significant event — the 30-year Treasury bond auction.

When the results came in slightly weaker than expected, bond prices dipped modestly, which pushed yields (and mortgage rates) a bit higher.

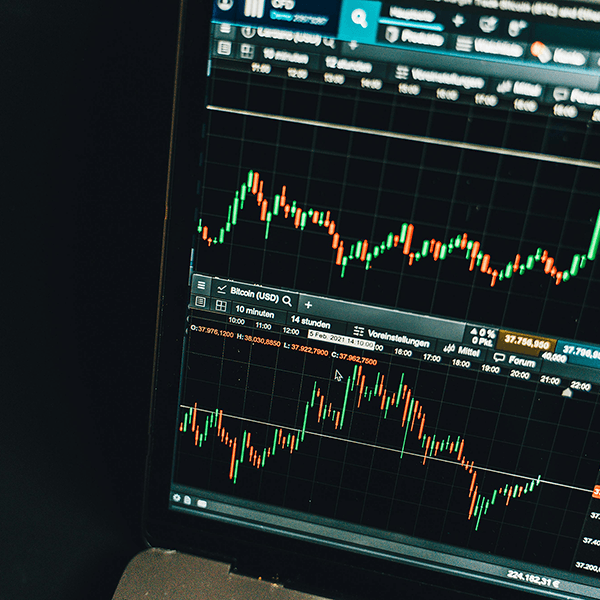

What’s Going On With Bonds and MBS

The 10-year Treasury yield stayed within its familiar range between 4.08% and 4.20%, a band that has defined nearly all trading over the past few weeks. Mortgage-backed securities (MBS) — the bonds most closely tied to mortgage rates — followed a similar pattern but underperformed Treasuries this afternoon.

That’s a common occurrence at the end of an auction cycle. In the days leading up to Treasury auctions, MBS often outperform as investors adjust their positions. Once the auctions wrap up, Treasuries tend to recover a bit of that ground, leaving MBS lagging temporarily.

By the end of the day, MBS were down about a quarter point, while Treasury yields rose roughly 2–3 basis points. The average 30-year fixed mortgage rate responded by moving just slightly higher, hovering near 6.38%, still well within its narrow range.

What It Means for Buyers and Homeowners

Even though today saw a small uptick, the bigger story is stability.

For almost a month, the average 30-year fixed has barely budged — oscillating within a few hundredths of a percent despite daily headlines.

Here’s why that matters:

-

For buyers: Small changes in rates like this typically move payments by just a few dollars a month. Stability gives you more confidence when locking a loan or shopping for a home.

-

For homeowners: Refinance opportunities aren’t disappearing overnight. This kind of steady rate environment helps you plan your next steps with less urgency or risk of surprise jumps.

-

For agents and lenders: With the shutdown freezing major reports, volatility remains low — a window that allows buyers to act without the fear of missing out on sudden dips.

Looking Ahead

For now, the bond market remains “range-bound,” meaning prices and yields are stuck between familiar levels. A lasting move higher or lower will likely require new economic data — particularly the official jobs report that’s been delayed by the shutdown.

Until then, small technical factors like bond auctions and overseas markets are driving the day-to-day changes.

Bottom Line

The average 30-year fixed mortgage rate inched up slightly today, mainly due to softer demand in the 30-year Treasury auction and mild MBS underperformance. But rates remain inside the same tight range they’ve held for weeks — stable, steady, and waiting for the next major data release.

Want to see what that looks like for homes you’re considering?

Just comment, message, or give me a call—I’m here to help!

#average30yearfixed #mortgageupdate #housingmarket #homebuying #refinancing #bondmarket #treasuryauction #mbs

Source: Mortgage News Daily